| |

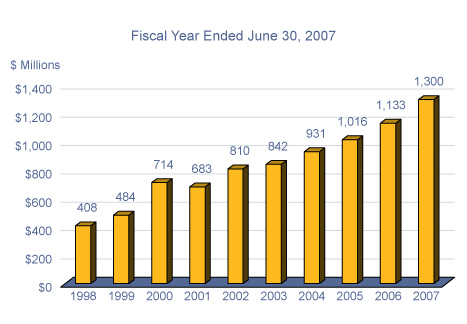

The UCLA Foundation benefited from continued growth in both donor support and investment returns, which together have allowed the Foundation to support expenditure increases in the form of grants and other transfers to the campus. Net assets, which represent the excess of total assets over total liabilities, grew by $166.3 million to $1.3 billion for the year ended June 30, 2007. Total assets increased 13% to approximately $1.5 billion and total liabilities increased 5% to $179.8 million as of June 30, 2007. The increase in net assets of $166.3 million in FY07 represents a 42% increase in income as compared to an increase in net assets of $116.9 million in FY06.

In FY07, the Foundationís revenues in the form of contributions from donors were $146.4 million, a 33% increase over FY06, while expenditures in the form of grants and transfers to the campus were $162.6 million, a 37% increase over FY06. The operating deficit of $16.2 million was offset by the Foundationís non-operating income of $142.9 million. The non-operating income increased by 61% compared to FY06 due to a combination of higher investment returns on higher investment balances. The Foundationís other income in the form of private gifts of permanent endowments was $39.6 million, a 9% increase over FY06.

The total fiscal year 2006-2007 payout available to the campus amounted to $37.1 million, up from $32.3 million in fiscal year 2005-2006. Annual payout to the campus continues to grow, consistent with the Foundationís goal to provide payout that is predictable, sustainable, and preserves equity among generations.

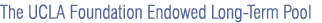

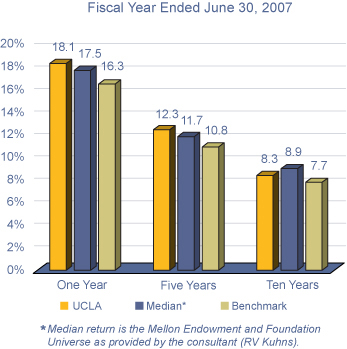

The charts and graphs below summarize the net assets and endowment performance of The UCLA Foundation for the fiscal year ended June 30, 2007.

The UCLA Foundation's net assets were more than tripled over the past 10 years due to significant donor support and strong investment performance. The Foundation's net assets represent total assets less total liabilities, resulting in fund balances to support UCLA's mission.

|

| |

|

The UCLA Foundationís endowed long-term pool investment returns exceeded the custom benchmark over all periods including one, five, and 10 years. |

| |

|

The UCLA Foundationís endowed investment pool totaled $953.4 million. The endowed long-term pool comprises a diversified investment portfolio that is designed to maximize long-term returns and limit composite portfolio volatility, consistent with accepted institutional investing principles and practices. Alternative investments (including private equity, absolute return and resource/inflation hedging strategies) represent a significant and growing percentage of the pool.

|

| |

|

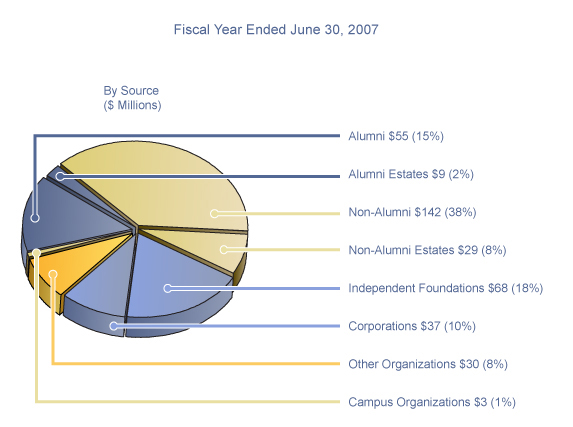

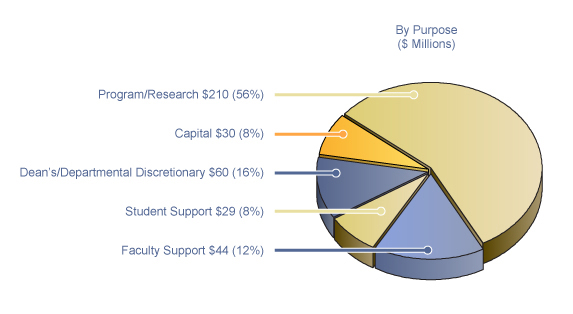

UCLA received more than $373 million in gift support, a 20% increase over last fiscal yearís total. Giving from alumni and alumni estates represented 17% of gifts received. Support for faculty and student recruitment and retention totaled more than $73 million, continuing the Universityís efforts to address the critical needs for endowed chairs, scholarships, and fellowships.

|

| |

|

| |

|

|